California EDD Certification Questions Guide

Understand what all the questions mean on the EDD Certification Form

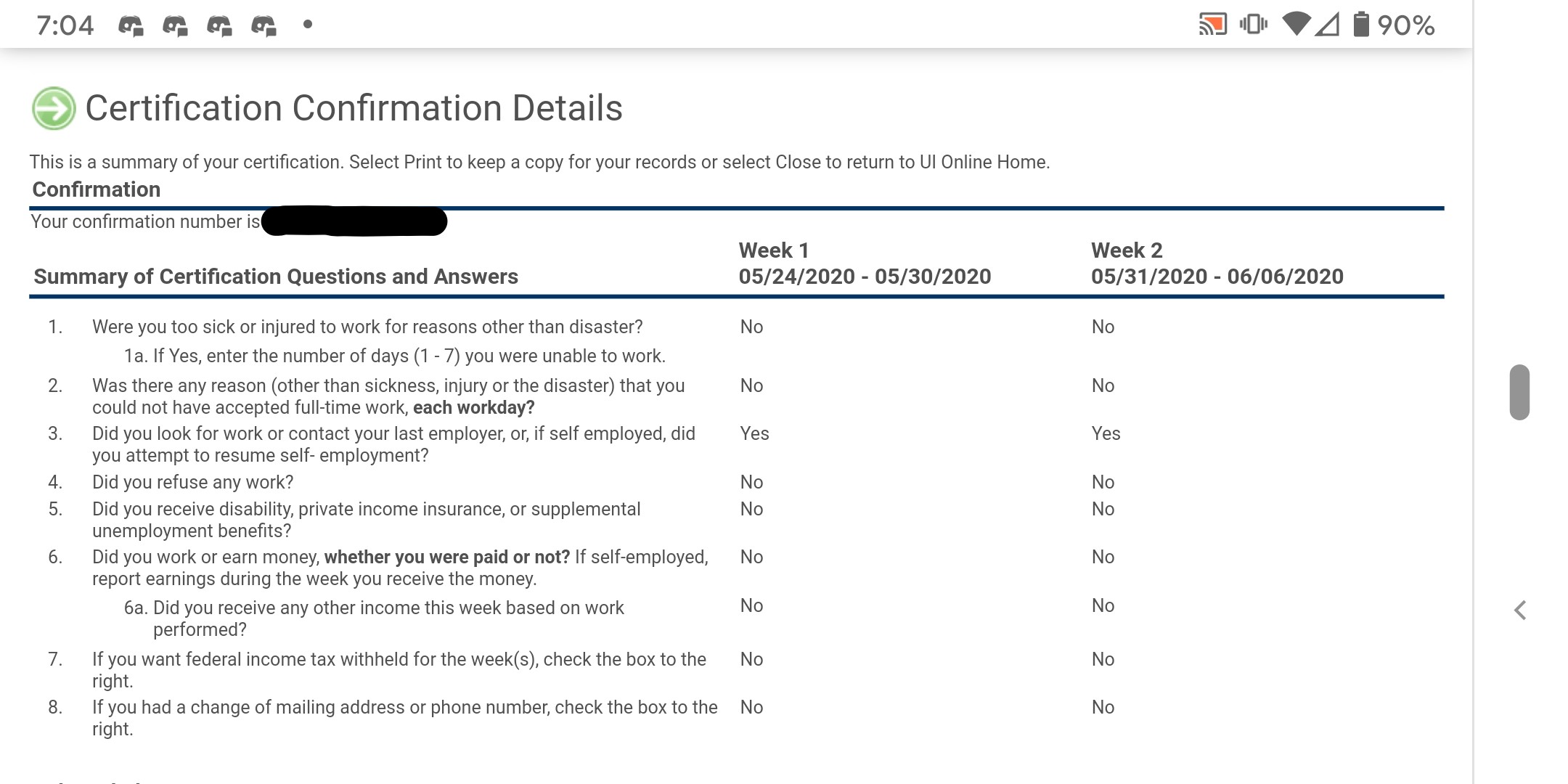

In California, every two weeks, you need to certify in order to get your UI or PUA benefits for those weeks. Certification involves answering a series of questions

to determine continued eligibility for the unemployment insurance benefits and PUA. You will not get paid until you certify, and if you fail to certify in a timely manner

your claim may be closed, and you will need to re-open it or file a new claim. In some cases, the EDD may auto-certify the weeks ending at March 14 through May 9. You can

certify online, by phone, or by mail. It is recommended you certify on-line for fastest processing. You can certify through the UI portal on the EDD website. After you log

in it should show you what weeks you have to certify.

The certification window starts at Sunday 12:01AM and covers the two prior weeks, so remember to log in every two weeks

as soon as you can and complete the certification process for those weeks. After you certify status will change to "Pending", and within 24 hours usually (though in some cases

it takes longer) it will change to "Paid" which means money has been disbursed to your account (though it may take a few more days to show up on your EDD Debit Card). Many people

report certifying at midnight before going to bed and seeing the status has already being changed to "Paid" by the time they woke up at 8:00am in the morning! If it's been more than two or three days

and it is still on Pending status, there may be an issue and you will want to contact the EDD.

Below are the questions you will need to answer every time you certify. You should try and answer accurately and truthfully otherwise the EDD

may find that they overpayed you and you will need to pay back any overpayment amount along with fines and penalties.

1. Were you too sick or injured to work for reasons other than disaster?

Since you must be available and willing to work, being sick of injured (other than for COVID-19 specific reasons) may affect your UI eligibility. Answer "No" if you were available and physically able to work every one of the days in the week and you were not sick or injured, then skip question 1a and proceed to question 2. Otherwise if you had some sickness or injury preventing you from working, answer "Yes" and proceed to question 1a.1a. If Yes, enter the number of days (1-7) you were unable to work.

If you answered "No" to question #1, skip 1a. Otherwise, put in the number of days of that week that you were sick or injured and unable to work. If you were sick or injured because of the Coronavirus, it does not count. Only put the days in where you were sick for reasons other than Covid19. Your UI benefits will be reduced proportional to the number of days you mark you were sick or injured. For example, if you put that you were sick or injured for five days that week, your benefits will be reduced by 5/7. This won't affect the extra $600. For example if your weekly benefit was $210 and you were sick 5 days, you will receive $150 + $600 for that week instead of $210 + $600.2. Was there any reason (other than sickness, injury or the disaster) that you could not have accepted full-time work, each workday?

Say "Yes" if there was any other reason that you could have not accepted full time work each workday. If you answer "Yes" to this question, the EDD may schedule an interview to determine your continued UI Insurance eligibility, since you should be willing and available to accept work every day. If the reason is related to the COVID-19 virus, you can still say "No" here.3. Did you look for work or contact your last employer, or, if self employed, did you attempt to resume self-employment?

While on Unemployment Insurance Benefits, you are supposed to be looking for work and contacting your last employer (if furlough), of if you were self employed or independent contractor, you were supposed to try to resume your self-employment work.IMPORTANT: The EDD has issued a COVID-19 Temporary Exception stating that "You are not required to look for work each week to be eligible for benefits." However it's been reported that answering "No" to this question still causes problems and causes your certification status to be stuck on "Pending".

If you answer "Yes", you will see another form on the next page asking you to describe your work search efforts, including Date of Contact, Type of Work, Employer/Agency Name, Contact Type, Outcome of Contact, If you selected in-person contact as your contact type please complete the person contacted, name of person contacted, if you selected email or online as your contact type please complete the website URL/Email of contact field below, phone/fax number, If you selected Mail as your contact type please complete the address fields below, and whether you have any additional work search records to report. If you are self employed you should put your own contact information as the employer name.

NOTE: You may leave this form blank and just press "Next" if you'd rather not document your work search efforts at this time.

4. Did you refuse any work?

If you refused any work or job offer from an employer that week, answer "yes". Since you are supposed to accept any suitable work, this may affect your eligibility and the EDD will schedule an interview to check whether you had valid reason (such as job not suitable for your occupation and educational background) to refuse the work you were offered or whether this makes you ineligible for UI compensation. If you had no job offers that week and did not refuse any work, answer "no".5. Did you receive disability, private income insurance, or supplemental unemployment benefits?

If you received any of the income listed above, answer "Yes". Such income may affect your eligibility for unemployment benefits. For example, since you are supposed to be able to work every week, getting disability income might infer a short or long term disability that prevents you from working thus making you ineligible for unemployment compensation, although in some cases you may be eligible for both.Note that Social Security Income does not have to be reported for this question and won't affect your PUA application or your benefits. The PUA benefit you received itself is also excluded for the purpose of this question. So you can still answer "No" even if you received Social Security and PUA. If you are not a PUA applicant, you may see for question #5, instead of the above:

5. Did you begin attending any kind of school or training?

Answer "Yes" only for the week in which you began the class or began a new term. Since you must be available for work every week and since attending school could mean you are not available for work, this may affect your eligibility for UI benefits and the EDD could schedule an eligibility interview or mail you a questionnaire to determine whether you are still eligible. If you did not begin any classes or training that week, answer "no".6. Did you work or earn money, whether you were paid or not? If self-employed, report earnings during the week you receive the money.?

If you worked that week and earned a salary, you must answer "Yes" to this question, even if you have not been paid yet. If you are self-employed or Independent Contractor, you will only report earnings during the week you receive the money.6a. Did you receive any other income this week based on work performed?

Answer "Yes" only if you received any other type of income based on work performed this week.If you answered "Yes" to question 6, on the next page there will be a form where you can submit further details such as the Employer Name, date last worked, total hours worked for this employer, gross earnings before deductions for this employer, wage type, employer type, and whether you are still going to work for this employer. Note that it is still possible to get unemployment money and the extra $600 if you worked part time. For more information, see: Can I work part time and still collect unemployment and the $600 FPUC?

If you answered "No" to question 6, then on the next page you will be asked "Did you receive any other type of income such as the following: Pension, Residual Pay or Holding Fees, Severance or Employment Separation Pay, Vacation or Hiatus Pay, Jury Duty, Sick Leave Pay, Holiday Pay, Workers' Compensation, Wage Continuation Pay, Bonus, In Lieu of Notice Pay, WARN Pay, Witness Fees not including mileage reimbursement, Back Pay Award, Incentive Pay, Idle Time/Show Up or Stand-by Pay, Royalties, Supplemental Unemployment Benefits, Script Option Payment, Retirement Funds Disbursement (401k, etc) Lump Sum, Profit Sharing, Strike Benefits. Answering "Yes" to this question may affect reduce or affect your eligibility for payment benefits. For example, if you received sick or vacation pay, it raises the question whether your employment has really been terminated.

7. If you want federal income tax withheld for the week(s), check the box to the right.

This question appears for week 2 of the two weeks you are certifying for. The unemployment compensation you receive is taxable and reported to the IRS. If you answer "Yes" to this question, the EDD will automatically withhold 10% of your benefits for the federal income tax. Since for the unemployed every cent can matter to make ends meet, many choose "no" for this question, but if you do remember to plan for paying tax on this income when you submit your tax return next year. Your benefits are taxable at the federal level, but not at the state level. Note that the EDD will only withhold from the regular weekly benefit amount and not the extra $600 FPUC, so keep that in mind. For example if your weekly benefit amount is $167 + $600, the EDD will withhold $17 from each week's payment. You can make a new withholding choice every time you certify.8. If you had a change of mailing address or phone number, check the box to the right.

Make sure to check the box if you moved since you last certified so that you can update your mailing address with the EDD. Same goes for your phone number, so they can contact you by phone if needed. You will be able to update your contact information in your personal profile, or you could complete a paper form and send it by mail. This question also appears only for week 2 of the two weeks you are certifying for.Also see: UI Certification Guide